Advertisements

If you want to make a credit card online, follow the steps below. how to get a Nubank credit card.

We can say that Banco Nubank has become the main reference in credit card in Brazil.

After all, it has won over millions of customers with its innovative proposal, humanized service and intuitive application.

Advertisements

If you want to be part of the Nubank community and enjoy the benefits of your credit card, just follow the step by step.

1. Basic requirements to apply for Nubank

Firstly, for request Nubank card, you must be over 18 years old.

Furthermore, if you are an account holder at a bill-issuing bank, it makes releasing your card easier.

And likewise, have a good credit score (Serasa Experian, Boa Vista SCPC).

The request from the Nubank credit card may be requested by your Android smartphone or iOS.

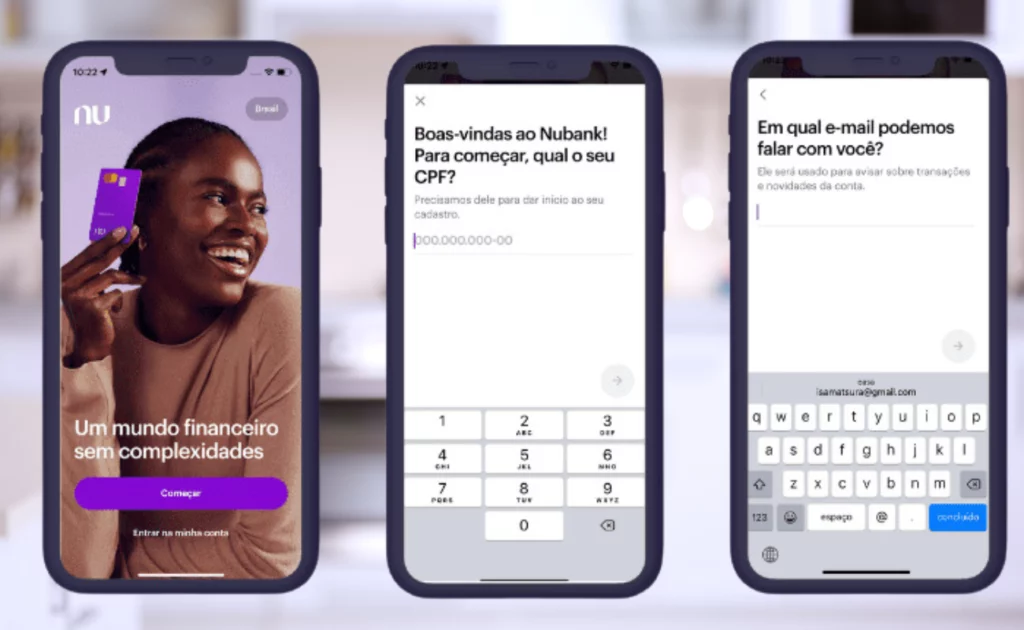

2. Step by step to request the Nubank card

Access the Nubank website or app, the best-known bank in Brazil.

Download the Nubank app on your smartphone or visit the official website.

Click on “Request your card”.

2. Complete the request form

After downloading the app, you need to provide your personal details, such as your full name.

And in the same way with your CPF, date of birth, address and telephone number.

Enter your bank details, such as account number and branch.

Answer some questions about your financial habits and monthly income.

3. Wait for the credit analysis

Furthermore, Nubank will analyze your order and your credit score.

However, the response may take a few days or weeks.

4. Activate your Nubank card

Fourth, if your request is approved, you will receive an email with instructions to activate your card.

So, just follow the instructions to create your password It is unblock the card.

3. Tips to increase your chances of approval

Another very important point is maintaining a good credit score.

Remember that to gain approval, pay your bills on time.

Additionally, have a positive credit history, and maintain a positive balance in your bank account.

Finally, respond to the request form carefully and honestly.

4. What to do if your request is denied

Don't despair, check the reason for the negative in the Nubank email.

Correct the problems that caused the denial, and then try again after a few months.

5. Benefits of the Nubank card

Zero annual fee: No monthly costs.

Full control via the app: Access your invoice, make payments and block your card.

Card without numbers: Security against fraud.

Cashback: Get part cash back on your purchases.

Fidelity program: Exchange your points for products and services.

Humanized service: 24/7 support.

Finally, O Nubank is a financial institution responsible and careful in credit analysis.

By following the tips above, you increase your chances of having your request approved and enjoy the benefits of Nubank card.

Now, it's just request your Nubank card and start your journey with this financial institution.